Why choose Bronze+ Young Choice

Enjoy shorter hospital wait times that can be over a year long in public hospitals and a high level of care with Australian private hospitals, plus access to benefits for dental, optical and more.

Comfort and care

Reduced medical costs

What's covered with Bronze+ Young Choice

For included hospital services we provide medically necessary inpatient treatment, accommodation, theatre fees, intensive care and hospital medication. For restricted hospital services we pay the default benefit for accommodation and no benefit for theatre fees.

What's not covered with Bronze+ Young Choice

No benefit is payable on excluded services – including for accommodation or medical fees. Out-of-pocket costs may arise for some procedures such as robotic surgery, high-cost pharmacy or consumable items, or fees charged by medical professionals.

- Pregnancy and birth

- Back, neck and spine

- Heart and vascular system

- Joint replacements

SEE ALL EXCLUSIONS

Why trust us with your health

As a member-owned and not-for-profit health fund, we give more back to members and have been providing quality health cover for teachers and the education community for over 50 years.

Do you need help finding the right cover?

Tell us about yourself and in only 20 seconds we’ll find our best cover to suit your needs.

Download guides

This cover has a $250 hospital excess to reduce premium costs. Extras limits reset annually on January 1. For more information on limits and waiting periods please see the product guide.

FAQS

For all new memberships and upgrades of cover (where your new cover has higher benefits or more services), including transfers from another fund, the following waiting periods will apply:

two months for all extras services, unless specified otherwise

six months for Active Health Bonus, outpatient midwife services and optical (Family Extras, Healthy Options Extras and Mid Range Extras only)

twelve months for major dental, orthodontia, orthotics, hearing aids, mechanical/health appliances and prostheses that are not surgically implanted

If you have transferred from another health fund on a comparable level of cover and have served waiting periods you will be able to claim straight away. See your product guide for details on services available on your level of cover.

As your situation changes throughout life, your health cover needs to change with it. We recommend you review your cover periodically and around any significant events. Getting hitched? Switch from single to couple membership. Welcoming your first child? Increase your level of cover and later switch to family membership. Kids over 21 years of age and still need cover? Get extended dependant cover. Kids all grown up and moving out? Remove them from your policy.

You can update most of these details on our member portal, download a Change to Membership Details form or use our mobile app.

Changing your level of cover

Waiting periods apply for

existing members who increase or upgrade cover, including changing to a different excess; and

new members transferring from a lower level of cover at another fund.

The previous level of cover continues to apply until all appropriate waiting periods for the new cover have been served. Years of membership with your previous fund are not recognised. Please contact us if you wish to discuss your individual circumstances.

If you reduce your level of cover, the lower benefits on your new cover will apply immediately if you have already served the required waiting periods.

Changing who is covered

You can update persons covered on the member portal, on our mobile app, or use the Change to Membership Details form.

You can add a student or dependant who is over 21 to your policy on the member portal or use the Adult Dependant Registration form.

Adding a new adult or dependant to your policy or removing someone from your policy (including a deceased person) may lead to a change of membership category, so please let us know as soon as you can.

Changing your contact details

You can change your contact details on the member portal, on our mobile app, or use the Change to Membership Details form.

Changing your payment preferences

You can change your payment method or frequency on the member portal, on our mobile app, or by calling us. See Premium Payment Options.

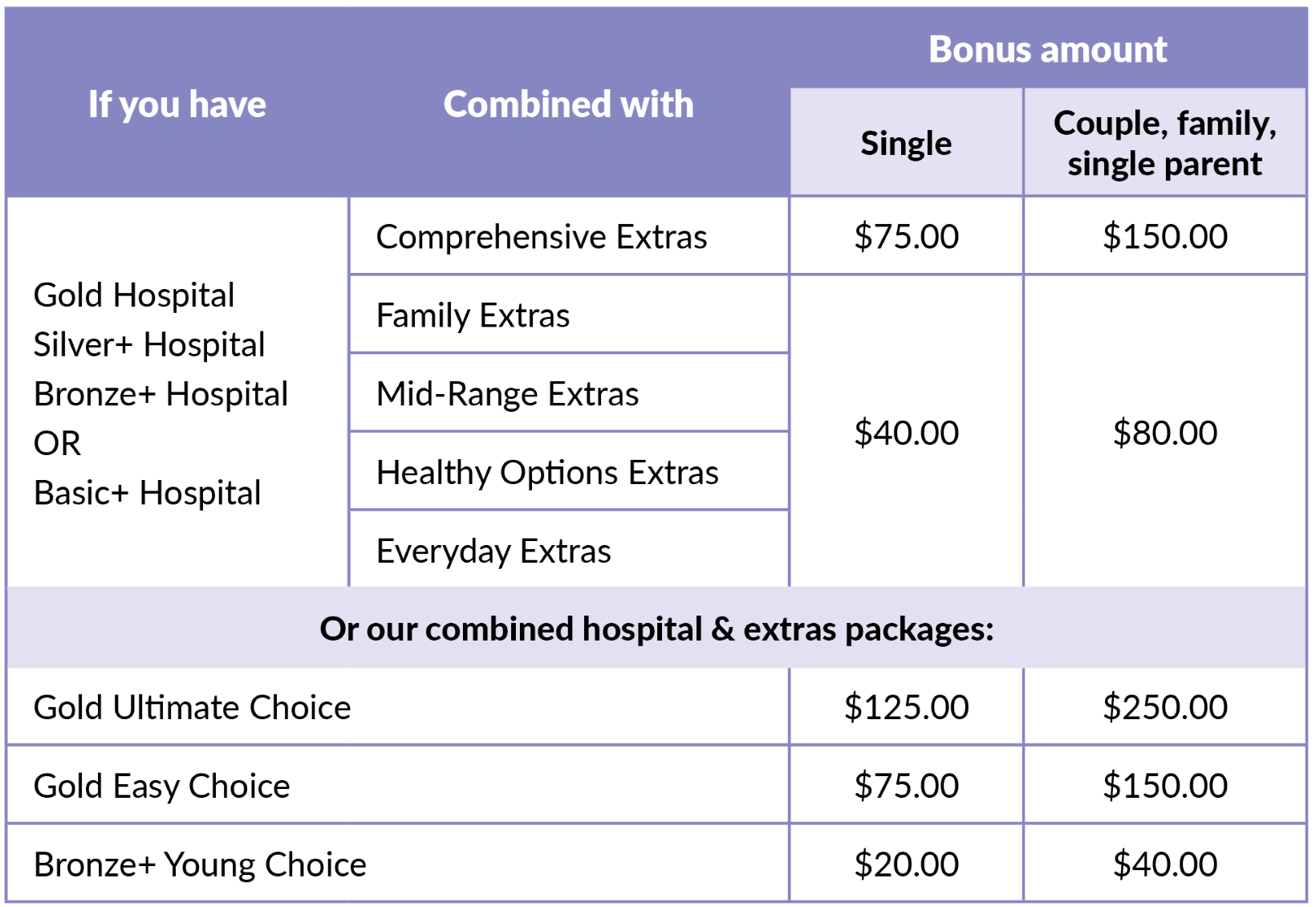

The Active Health Bonus is a reward available to members on any of our combined hospital and extras products (except products combined with Basic Extras), when one adult member completes the Health-e-Profile, our online health assessment, in each consecutive twelve month period. You may use the bonus to pay the out-of-pocket costs for extras treatments (up to the annual limit).

The Active Health Bonus limit is per policy, per calendar year. A six-month waiting period to receive the bonus applies from your join date.

The following are not claimable under the Active Health Bonus:

co-payments for Pharmaceutical Benefit Scheme (PBS) prescriptions

any difference between the Medicare Benefits Schedule fee and the doctor’s charge for medical expenses

any medical expense our Fund Rules or legislation prevents us from paying

hospital excesses.

If you decrease/change your level of cover, you may receive a reduced or no Active Health Bonus.

How much bonus will I get?

How to claim your Active Health Bonus

You can claim the Active Health Bonus by using any of Union Health's approved claiming methods, just tick the checkbox on our online or manual form.

Benefits can only be paid for services which have been paid in full.

Receipts/accounts must have the following information:

Name and address of the person, organisation or clinic who provided the service

Name of the person who received the service

Date of service

Whether the account has been paid in full

Itemised cost of service, including item numbers or description of the product or service

Cash register dockets will not be accepted.

You can also claim via HICAPS by answering “yes” when asked if you wish to claim your bonus. Note that HICAPS, which is an external system, will be unable to show you how much Active Health Bonus you have available.

Active Health Bonus conditions

No benefits are payable for services which were provided whilst not participating in the health assessment, including lapsed periods.

The Active Health Bonus is paid per policy, per calendar year. One family member may claim the entire bonus, or it may be spread across several services for different family members on the policy.

We will pay claims in order of when we receive them.

Direct debit

Payments can be debited fortnightly, monthly, quarterly, half-yearly and annually.

Credit card

Payments can be debited fortnightly, monthly, quarterly, half-yearly and annually.

Complete a Direct Debit request form to authorise us to make periodic deductions from your debit or credit card account.

Rate protection

You may pay your membership for up to twelve months in advance at the rate that applies at that time. This means that you will not have to pay extra for the period covered by your premium payment if premiums increase during the period for which you have paid. Rate protection will cease if you change your level of cover or suspend membership. Any amount paid in advance of the date of the cover change or suspension will be applied at the rate that is current at that time.

Can others operate the policy?

A policyholder can request that their spouse/partner (on the same policy) be authorised to operate the policy on the same level as the policyholder (excluding joining/terminating membership and removing dependants). This can be done by contacting us or by submitting the Authority to Access Membership form. The policyholder may withdraw the authority at any time by notifying us, in writing or over the phone.

In any other circumstances, we will only take instructions from someone that is named by the policyholder under a Power of Attorney. You can also authorise a third party to enquire about your membership but not make any transactions on your behalf using the Authority to Access Membership form.

Overseas travel

If you are travelling overseas and have been a financial member of Union Health for at least twelve months, you may suspend your membership for a minimum period of two calendar months to a maximum period of three years. Premiums must be paid up to the date after you depart Australia, i.e. your suspension date plus one day. Two suspensions are allowed per calendar year. The second suspension can commence after you have resumed the policy for a period equal to the length of your previous absence or nine months, whichever is shorter. No claims can be made while your membership is suspended.

Travel information to verify departure and return dates will be required at the time of application for suspension, unless you have a one-way ticket, in which case verification of return date will be required on resumption.

Please refer to the conditions that apply to suspension of membership, which are listed on the Membership Suspension Request form.

The remainder of any waiting periods not completed prior to departure will continue when the membership is resumed.

Financial hardship

If you are experiencing financial hardship and have been a financial member of Union Health for at least six months, we may allow you to suspend your membership for a minimum period of one month to a maximum period of twelve months.

We'll consider your request to suspend your cover if you experience:

- loss of employment

- significant decline in retirement income due to extrordinary circumstances

- significant extraordinary events like natural disasters

Multiple suspensions are allowed, however, twelve months must be served between consecutive suspensions. No claims can be made while your membership is suspended or for treatment that occurred while your membership was suspended.

Download the Membership Suspension Request form.

SEE ALL FAQS